Assessment

Properties in Manitoba are assessed every two years to ensure assessment values keep pace with changing real estate market values.

In Manitoba, property is assessed at market value in accordance with The Municipal Assessment Act. Market value is the most probable selling price of the property had it been sold by a willing seller to a willing buyer.

Steinbach assessment office 1-204-326-9896 or 1-866-216-9342.

Property owners have the opportunity to appeal their assessment. The deadline to appeal 2026 assessment is August 18th ,2025.

If you have questions about an appeal, please call the Board of Revision at 311 or toll free 1-877-311-4974.

School Division and Provincial Education Support Levy

The Village of St. Pierre-Jolys does not set the these millrates. We collect these funds on behalf of the school divisions and public school boards.

By-Law

The following by-laws are in effect for the 2025 tax year:

Borrowing Bylaw Library – set rate

Recreation & Culture Levy – set rate

Local Improvement - .564 millrate

Garbage & Recycling – set rate

F/P Protection Services – 3.001 millrate

Wastewater Levy – set rate

L_IMP Sewer Renewal – set rate

General Municipal at Large Mill Rate = 13.438

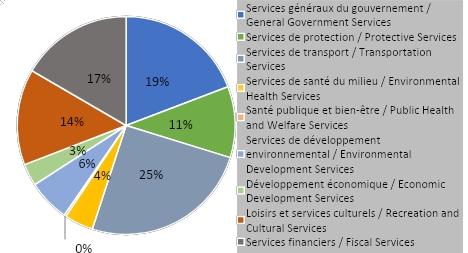

Pie chart of our budgeted general expenditures

Your Tax Bill Explained: